The Basic Principles Of Estate Planning Attorney

The Basic Principles Of Estate Planning Attorney

Blog Article

Estate Planning Attorney - Questions

Table of ContentsGetting The Estate Planning Attorney To WorkThe Estate Planning Attorney StatementsThe Definitive Guide to Estate Planning AttorneyA Biased View of Estate Planning Attorney

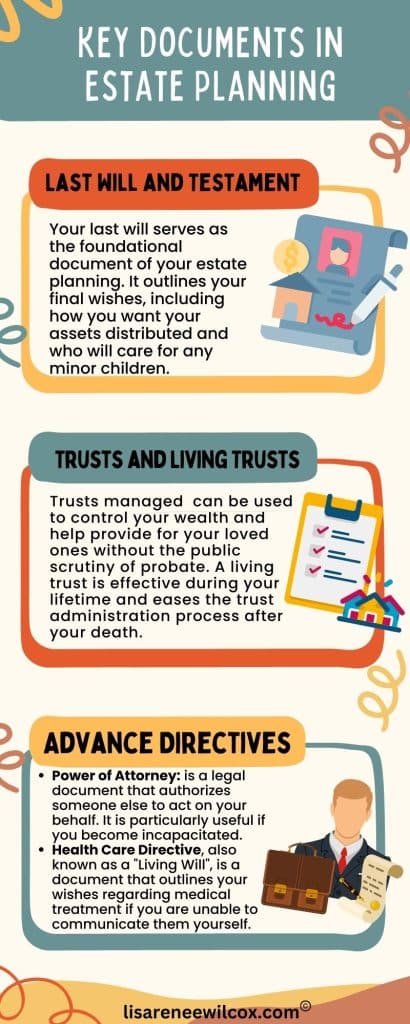

Estate planning is an action strategy you can utilize to establish what takes place to your assets and obligations while you live and after you pass away. A will, on the various other hand, is a lawful record that outlines how assets are distributed, who takes care of children and animals, and any type of various other desires after you die.

Insurance claims that are denied by the administrator can be taken to court where a probate judge will have the final say as to whether or not the insurance claim is legitimate.

What Does Estate Planning Attorney Do?

After the supply of the estate has actually been taken, the worth of possessions determined, and taxes and debt paid off, the executor will certainly after that look for permission from the court to distribute whatever is left of the estate to the recipients. Any inheritance tax that are pending will certainly come due within nine months of the day of fatality.

Each individual areas their possessions in the depend on and names somebody other than their spouse as the beneficiary., to sustain grandchildrens' education.

Little Known Facts About Estate Planning Attorney.

This method entails freezing the value of a possession at its worth on the date of Clicking Here transfer. As necessary, the quantity of possible capital gain at death is likewise iced up, permitting the estate planner to estimate their potential tax obligation liability upon death and much better prepare for the settlement of earnings taxes.

If adequate insurance proceeds are offered and the plans are effectively structured, any type of revenue tax on the deemed dispositions of possessions adhering to the fatality of a person can be paid without resorting to the sale of assets. Proceeds from life insurance coverage that are gotten by the recipients upon the fatality of the guaranteed are usually income tax-free.

Various other charges connected with estate preparation consist of helpful site the prep work of a will, which can be as reduced as a couple of hundred bucks if you make use of among the ideal online will certainly manufacturers. There are specific records you'll need as part of the estate preparation procedure - Estate Planning Attorney. Several of one of the most typical ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate planning is just for high-net-worth individuals. Estate intending makes it much easier for individuals to establish their desires before and after they pass away.

The Best Guide To Estate Planning Attorney

You ought to begin planning for your estate as quickly as you have any measurable property base. It's a continuous process: as life advances, your estate strategy should move to match your situations, in accordance with your brand-new objectives. And maintain it. Refraining your estate planning can trigger excessive financial concerns to enjoyed ones.

Estate planning is commonly assumed of as a device for the affluent. Estate planning is likewise an excellent method for you to lay out plans for the care of your minor children and pets and to detail your dreams for your funeral service and preferred charities.

Qualified applicants who pass the examination will certainly be formally licensed in August. If you're qualified to sit for the examination from a previous application, you might submit the brief application.

Report this page